MPC Energy Solutions, an undiscovered renewable energy gem

With a Price-to-Book (P/B) ratio of 0.39 and at an inflection point, I anticipate an upside of around 100% over the next two years.

MPC Energy Solutions ($MPCES) was initiated and taken public in January 2021, on the peak of the renewable energy boom and raised $90 million through a private placement before the IPO. Three years later, it only has a market cap of around 27m USD (at a current share price of around 13.15 NOK at the close of 23.05.2024). There are no writeups on the company and the trading volume is extremely low. Recently, one analyst of NuWays started to cover the company (link).

MPCES stands at an inflection point as 2024 will be the first year in which all previously constructed assets are fully operational and the company will be profitable for the first time in history. This milestone could be further amplified by extra income from selling assets from their >300MW development backlog—a move that could be transformative for the company. With a price-to-book ratio of just 0.39 and improving fundamentals, now might be a good time to invest.

Disclaimer: I am invested. This is my first writeup so I would highly appreciate any feedback!

The company

MPC Energy Solutions was launched by the German investment company MPC Capital as a “renewable energy platform” in January of 2021 on the Oslo Stock Exchange. Their headquarters is in Amsterdam. In their first half year report, the company consisted of four ready-to-build projects in El Salvador (Santa Rosa & Villa Sol), Colombia (Los Girasoles, Planeta Rica) and Puerto Rico (Neol CHP) with a total capacity of 63 MW and $83m in cash.

MPC Capital is a German asset and investment manager with focus on real estate, shipping and renewable energy. They hold around 20,5% of the shares of MPC Energy Solutions (last update January 2024). The goal was to implement projects with more than 500 MW of installed capacity of renewable energy infrastructure over the next two years after the IPO in the Caribbean and Latin America.

They were constructing an organization geared for substantial growth and opened offices in Colombia and Panama. Their plan involved raising additional capital to swiftly expand the planned capacity.

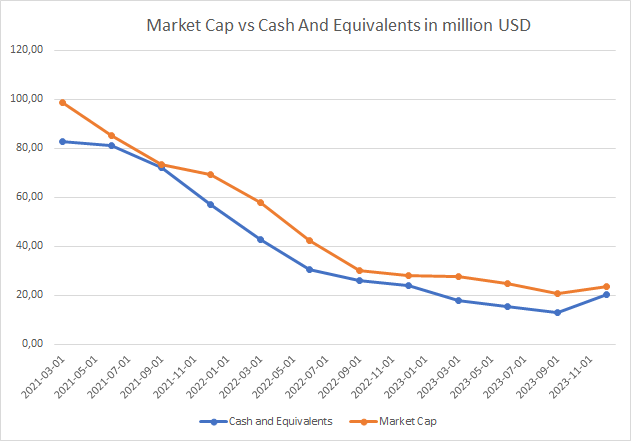

However, this occurred at the peak of the renewable energy boom. The share price began to decline rapidly as the market anticipated higher interest rates. The market capitalization consistently hovered around the level of cash held by the company, effectively valuing the assets they were own at zero. A year later, the share price had already halved.

In February 2022, they purchased a 15.8 MWp solar park in Mexico, Los Santos Solar I project, located in the state of Chihuahua.

On the 5.7.2023 the CEO resigned for undisclosed reasons. It could be due to some strategic disagreements but that is pure speculation from my side. The CTO Stefan H. Meichsner took over and has filled both positions since then. No successor has been named so far.

Over the past years, they have maintained a costly overhead organization relative to the size of their portfolio (2023: $5.1m, 2022: $4.3m), with very little revenue to offset these expenses, resulting in significantly negative earnings.

They also divested from two development projects, the St. Kitts project where they returned $10.8m of their investment, losing around $3.0m and Puerto Rico, a 2.6 MW combined-heat-and-power (“CHP”) plant which did not meet their investment criteria any longer. They are expected to not suffer any financial loss from this project but also did not recover the invested capital yet. Additionally, they reported energy trading losses, after there were delays in the construction of a PV plant in Colombia. They had to buy energy from the spot market as they were contractually obliged to deliver energy to their off-taker.

Meichsner changed the strategic direction from growth to cost savings and archiving profitability quickly. He cut overhead costs by 30% going into 2024 to $3.6m. He also put the focus on returning cash early from the projects by involving a co-investor which pays a development fee to MPCES. He also announced that MPCES wants to sell assets from their development backlog (more under “Business Model”).

As of now, they have 79 MW in operation, 65 MW under construction and 225 MW in late development (a total of >300 MW in development).

They announced that they will be profitable in 2024.

The Business Model

MPCES not only owns and operates renewable energy assets but also develops them from scratch. This involves securing land for power plants and transmission lines, signing long-term power purchase agreements (PPAs) with off-takers, and ensuring all permits are in place for connection to the public grid or a client’s private network. They manage the construction phase, typically handled by turnkey contractors who bring projects from the ready-to-build to ready-to-operate stage under their supervision. Thus, MPCES manages the full project lifecycle—from development and construction to operation and eventual decommissioning decades later.

The company is focused on the Central America and the Caribbean region. This geographical focus is due to several reasons. Primarily, the region is rich in solar irradiation. This is often measured in full load hours. For comparison, while projects in Europe offer 500-1000 FLH p.a., the company’s operational PV parks come in at roughly 2000 FLH. Moreover, in these areas, renewable energy is often underutilized or lacks diversity. Notably, energy costs in this region rank among the highest globally, sometimes leading in consumer energy prices. On average, prices are 30-40% above the US average and some 20% above the global average. Projects across MPCES’s target regions offer equity IRRs of >15% (assuming 75-80% leverage on project level), notably above Europe with 7-8% returns. Local governments are pushing for an energy transition to cut down on fossil fuel dependency, which is expected to lower power prices, benefiting both the country and its residents.

Here is an overview of their current asset locations.

In the future, MPCES wants, rather than owning 100%, to sell stakes in their projects to Co-Investors and collect a development fee. This approach enables the company to keep investing without needing to raise external capital, allowing it to realize profits early from the value generated through the asset's development.

It also significantly improves the IRR of their projects, derisks them and frees up capital to theoretically scale much faster. We can see the math on the example of their project they started building in February 2024, San Patricio in Guatemala. The project has 65 MWp. The building costs will be around 42m. It will generate $8m Revenue and $6,5m EBITDA. They will take a loan for 80% of the total costs. They plan to get at least $120k per MWp as a development fee from a co-investor. Let’s assume they sell a 49% stake. That means they collect a 3.8m development fee on the low end plus the proportional share of the building costs. So with the co-investor, instead of investing $8.4m, they would only invest $0.46m of their own capital for their 51% stake.

Additionally, they will start selling ready-to-build projects completely which they developed themselves. According to Stefan Meichsner, MPCES typically invests around $10-15k per MW during project development. In the ready-to-build state, they estimate the potential to sell projects for between $50k to $125k per MW, depending on the project and location, often leading to returning 10 times the costs if successful. This might be a game changer for the company, as it might significantly free up additional cash from their 300 MW development backlog.

However it's important to note that these projects often fail. The described 300 MW is the very certain part of the portfolio. There is much more in development which is less certain. Industry wide, 3 out of 5 projects fail. The main risks are: Access to the grid, support of local communities for environmental and construction permits, and especially finding a creditworthy off-taker. The latter is usually the first step for MPCES, meaning they sign a PPA before they start development. This increases their hit rate compared to other companies in the industry.

They announced that they are in talks about selling their entire Colombian development backlog. The reason is that they do not want to focus on Colombia anymore as they see inefficiencies in the processes, especially with local authorities. In addition, they had trouble finding proper interconnection points to feed power into the grid, especially because investments in the grid are lacking behind. However, they want to keep their office there, as they have skilled employees there, labor costs are comparatively low, and they can use their resources there for other countries like Guatemala, El Salvador, or the Dominican Republic as there is no language barrier.

Structure and Management

The company structure is somewhat complex. It was established by MPC Capital, a German company, resulting in a German management team and board. While headquartered in Amsterdam, MPCES operates across Central and South America, where it also maintains operational offices. The company is listed on the Norwegian stock exchange, and its shares trade in Norwegian Kroner (NOK). However, its earnings are reported in USD, and over 80% of their power purchase agreements (PPAs) are also denominated in USD. Their loans are also in USD except for Planeta Rica in Colombia, which is donated in Colombian Pesos.

The main reason for choosing Amsterdam as the headquarters is the favorable tax agreements with countries in Central America and the Caribbean. There is a long history between the Netherlands and this region. Oslo was chosen as the stock exchange location for two reasons: MPC had already had good experiences there with their shipping unit. And according to the company, Norwegian investors are long-term oriented and therefore match the approach of MPCES.

Stefan Meichsner serves as the primary executive at the company, holding both the CFO and CEO roles. He has more than 12 years of combined experience in the finance and renewables industry and worked for Siemens Energy and Stadtwerke München before. So far, he did a good job of putting the right measures in the current environment and correcting the course of the company.

Although Meichsner regularly purchased shares of the company, his total ownership remains relatively modest at 27,000 shares, valued at approximately $33.000. It appears that decisions are aligned with the interests of MPC Capital, which holds a 20.5% stake. They showed no intention to dilute themselves and other shareholders by a capital increase at the current price.

MPC Capital not only established the company but also provides different services to MPCES like transaction advisory services, asset management services, IT services, and services in connection with investor relations, human resources, public relations, marketing and ESG activities. Additionally, MPCES relies on their legal know-how quite a lot. The total amount of payments made to companies belonging to the MPC Group for services rendered amounted to $1.3m USD (2022: $1.9m). That seemed quite high for such a small portfolio but it is difficult to assess as a company outsider. Some of these contracts were renegotiated going into 2024 which is part of their cost cutting measures.

MPCES reports its financials in two ways:

IFRS Profit & Loss (P&L): Includes all income and expenses from consolidated projects and uses the equity method for non-consolidated ones. It also includes holding company expenses.

Proportionate Production P&L: Reflects income and expenses based on ownership percentage for all assets, including minority stakes and joint ventures. It excludes holding company financials.

This difference in reporting is important to understand when analyzing the company.

Valuation and Upside

MPCES has a market cap of $27 million and a total enterprise value of $54 million. According to their last trading update, they had free cash of 12m on corporate level on their balance sheet at the end of 2023. This cash is not for distribution and will be used to further invest into projects. Buybacks and dividends are not planned at the moment according to management.

Asset Value

The book value is around 70m so the P/B is around 0.39. Other companies in the space are valued significantly higher. E.g. 7c Solar has a P/B of 1.13, Scatec is at 1.35 and Neoen at 1.7. However these companies have a much larger portfolio, are profitable and offer dividend payments so they are not directly comparable. Additionally they operate in different countries.

A company that might be comparable when it comes to country locations is Polaris Renewable Energy as they also exclusively only have assets in Central and South America. However, they also have a lot of hydro power plants besides solar plants. They also trade at a very big discount to peers, having a LTM P/B of 0,71 and also looking very cheap on other metrics.

The book value is a good measure to see how valuable the portfolio is. Note that a solar park often generates energy over 30-35 years with increasing cash flows, as the loan gets paid off and the interest payments decrease. So the assets of MPC Energy Solutions have their best years ahead.

The book value (total equity) declined in the past years as earnings were negative.

My assumption is that this trend will reverse this year, given that they plan to report a positive EBIT and are likely to sell items from the backlog, which are currently recorded at cost in their books and might yield returns of 10x the cost. Consequently, such sales would increase the book value. When the market sees that the book value stabilizes or increases, it might trade closer to the peers P/B which would imply upside of around 100%.

Another way to compare the company is through EV/MWp. 7c Solarparken e.g. has an EV of $485,7m and has a portfolio of 465 MWp solar power plants so its valued at 1m per MWp. MPCES assets are valued at $0.6m per MWp. On the one hand, the portfolio of MPCES is much younger and more valuable because it has a longer lifetime ahead, on the other hand, again, MPCES is missing the scale of these other companies and operates in riskier countries.

The YieldCo Calculation

A different way to calculate a valuation for the current assets is by thinking about what would happen if they were to convert to a YieldCo. So a company that just collects the cash flows from the current assets, not developing or building any additional assets. This is purely theoretical as the company has no plans to do so and this is not my preference as an investor. However, it illustrates the possible value of the existing portfolio.

We assume the following:

Focusing only on administration while eliminating expenses related to development and construction, the company cuts overhead to 30%, which would result in overhead costs of around $1.1m.

A co-investor takes over 49% of the San Patricio project.

Selling the current 300 MW development backlog with a conservative value of $66,000 per MW brings in around $20 million.

Looking ahead to 2026, we project an enterprise value slightly above $40 million. We assume that all available cash will be directed towards debt repayment of $25 million. The financial breakdown is as follows:

With an EBITDA of $12.85 million (calculated as $8.5m plus $3.25m, minus $1.1m in overhead), we can calculate an EV/EBITDA = 3.11, EV/EBIT = 5.4 ($5.4m depreciation and amortization) and EV/EBT = 7 ($1.75m in interest at a 7% rate).

The free cash flow (FCF) before taxes, considering significant non-cash depreciation effects, is projected at $8.9m ($12.85 million in EBITDA minus $1.75m in interest). This results in an EV/FCF ratio of 3.6 before taxes. However, it is important to note that taxes and loan repayments, estimated at around $1.7-2m annually, must be factored into this calculation.

The FCF would go up each year as the loan gets paid down further. In this scenario, I guess they would trade at 2-2.5x the current price. The calculation shows what the assets of the company might be worth.

Profits from operational assets

In 2023, the company reported EBITDA on project level of $4.4m and a negative cash flow from operations of -$4.0m (2022: -$6.3m). For 2024, they guided $3.6m in corporate overhead costs (30% less than 2023) and project level revenue of $12m and EBITDA of $8.5m and $4.9m on the consolidated basis. Subtracting around $4m in Depreciation and Amortization, they should have a positive EBIT for the first time in their company history of a bit below $1m in 2024.

I expect the company to achieve a positive cash flow from operations in 2024. In my calculations they should do at least $1.3-1.8 million cash flow from operations before taxes depending on the amount of additional debt raised in 2024 for the San Patricio project and the interest rate of the loan for San Patricio excluding any profits from selling ready-to-build projects.

However they will have to repay $2.5m of their loans in 2024 so there will still be money flowing out of the company if they only have income from their current operational projects.

Assuming a co-investor takes a 49% stake in San Patricio, the company's loan would be $16.8 million. The project will generate around 3,25m additional EBITA per year. With a projected interest rate of 6.5% to 8%, this translates to additional interest payments of $1m to $1.3m in the first year. Considering these factors, the San Patricio project is expected to generate pre-tax free cash flow of $1.9m to $2.1m in the first year, increasing each year as the loan gets paid down.

With that, we come to around $3.8-4.1m cash flow from operations in 2026 before taxes from the assets in operation excluding any additional debt through further investments in projects. Their Enterprise value will be around 66m USD at this point. At that time, they will need to repay approximately $3.5 million of their loans. In their last annual report, they had an effective tax rate of 13.66%.

If the San Patricio project with a co-investor is successful, it will demonstrate the company's ability to scale up. By investing only a small amount of its own capital, the project significantly boosts profits, which are expected to grow as the loan is gradually repaid. With their large backlog of development projects, they can select the most profitable ones to focus on and sell the others.

I expect more lucrative projects to go into operation in the next few years without needing to raise any additional capital through a capital increase. This will significantly boost revenue and earnings.

Development Backlog

I assume that they will generate extra income in the meantime by selling off ready-to-build projects. Unlike their main business of constructing and operating renewable energy plants, which requires substantial assets, this development strategy (selling ready-to-build projects) is relatively asset-light and has high margins. The company is currently in the process of selling 100% of their Colombian project development backlog as this market is not core to them anymore.

At the moment, they have more than 300 MW in development that will reach ready-to-build with a high likelihood. 225 MW are considered to be in the late stage of development which should be ready-to-build this or next year. If they decide to sell 50% of these projects and we assume a conservative $70k for each MWp (they said they will sell between $50k and $125k USD/MW while spending around 10-15k for development), this could add $15.7m over the next two years of cash flowing to the company. This money could be invested in building some of their other projects.

Although the company has yet to record any sales, I see a high likelihood that they will successfully sell projects. Selling ready-to-build projects is a common practice in the industry, already undertaken by many other companies (e.g. Abo Wind, Novavis and many more) and the company is already in talks with potential investors. MPCES sees this as a long term business unit.

Interest Rates

If interest rates were to decrease, MPCES with a debt load of approximately $56 million in 2025 would benefit significantly. A reduction of 1% in interest rates could boost earnings by $560,000. As the debt load is expected to increase in the coming years, the impact of any interest rate changes will become even more significant.

Falling interest rates would also lead to a higher interest for companies like MPCES from investors as other relatively low risk investments get less attractive (e.g. bonds).

Downside and Risk

I find this investment very appealing also because I perceive the downside as limited. Given the current valuation, I see a margin of safety even if not everything unfolds as expected.

One risk which I see as unlikely is a capital increase at the current share price. Raising a substantial amount of capital would significantly dilute existing shareholders. The company's current actions, including their valuation and strategic direction, suggest no plans for such a dilution.

Other significant risks are the financial risks, off-taker- and political risks.

Since many of their loans have a variable base rate, rising interest rates would negatively impact the business (a 1% increase would increase costs by $0.4m at the moment, and more in the coming years). On the other hand, there are potential benefits if interest rates decrease.

Typically, each asset in their portfolio is backed by a contract with a single off-taker, ranging from private entities like Leoni to utilities such as Celsia and AES El Salvador. In the event that an off-taker declares bankruptcy, they must either secure a new client or attempt to sell the electricity on the public grid, a situation that could result in substantial financial losses. To mitigate such risks, they focus on forming partnerships with large, stable companies and diversifying their portfolio. Nevertheless, the situation with Leoni in 2022, which required restructuring, highlights the potential vulnerabilities. Although the restructuring was ultimately successful, it could have posed significant risks to MPCES.

Since they operate in Central and South America, the political risks are higher compared to more developed markets. According to their last annual report, these risks include changes in laws affecting the ability to get licenses, permits, approvals, secure guarantees, changes in taxation, or restrictions on moving capital to other countries. Another (unlikely) scenario is that if a socialist government takes over in one of the countries, they might want to nationalize the energy sector and expropriate the assets of MPCES in that country. Currently, there is no indication of this scenario in any of their markets. Although MPCES operates across various countries which reduces this risk somewhat, it will likely always result in the company being valued lower than others that mainly operate in developed countries.

Why does this opportunity exist?

I believe there are a few reasons why the current share price is what it is:

So far, they only reported a loss in each quarter. So the current positive development of becoming profitable in 2024 is not visible in their reports yet and therefore not screenable. However, Q2 2024 should improve significantly compared to Q1, since Q2 typically sees the highest energy generation and some expenses, such as insurance payments, are traditionally incurred in Q1.

Additionally, they haven’t demonstrated that they can successfully sell projects from their development backlog, nor that these projects hold the value the company suggests. A sale from the backlog could prove that their assets indeed have the value the company claims, and that their announced strategy works.

The broader industry is facing headwinds at the moment and is out of favour. So there are less investors looking for chances in the sector.

The company's structure—being German-founded with headquarters in Amsterdam, listed on the Norwegian stock exchange, and operating in Central and South America—might make it less visible and cause it to be overlooked.

Low trading volume hinders institutional investors from building relevant positions. Looking on Twitter (X) and other forums, there is nearly no one talking about the stock right now so it might be very much under the radar.

Summary and Conclusion

The company is at an inflection point in 2024. It will report profits for the first time in 2024 on an EBIT basis. It will likely generate additional income by selling ready-to-build projects.

I anticipate a potential upside of approximately 100%. Profitability should become evident in Q2 2024 and I expect that the first ready-to-build projects are sold in the next few months. These could be triggers for the share price in the short term. The San Patricio project, which will be operational in mid 2025, will significantly boost earnings and might be a catalyst for the stock price as well. Beyond this point, as additional projects come online, profits are expected to scale efficiently due to relatively stable overhead costs.

Furthermore, if interest rates decrease and the investment climate for renewable energy firms improves, this could have a lot of additional upside.

This might be an opportunity to invest very early in a business that has a long pathway of growth ahead, all at a very attractive price.

Hi Roman,

thank your for sharing your thoughts on MPCES. Nice Job. I knew lots of them, but not all. Well, I have also some thoughts, which might be interesting for you:

Hurricane risk and communication:

I thought a lot about the company and the risks behind. After a while I identified hurricanes as a critical major risk for the company. As we learned from New Orleans in 2005 or from Puerto Rico in 2017 hurricanes can eliminate whole landscapes, cities and for sure solar plants. I read the risk section of the latest annual report and there was only something very general:

"Operational risks include, without being limited to, adverse weather and resource volatility, mechanical breakdowns, spare part shortages, or failure to perform in accordance with specifications. While operational risks are usually insured by the Group through a third party, there is no assurance that all operational risks are borne by the insurer or that such parties will meet their obligations. In addition, the availability of insurance on commercially reasonable terms is not guaranteed for all projects.“

This is far too general for a risk, which can eliminate huge parts of their assets within hours. Because of this, I wrote an e-mail to investor relations and after 2 months I did not get an answer. Yesterday I wrote a friendly reminder. Looking ahead.

So here is a great mismatch between me and my risk awareness and the communication from the company. Although I really like this company and came to almost the same conclusion as you, this prevents a high engagement from my side. Nevertheless I could find some third party information about this. NuWays wrote in its analysis:

"Environmental risks: The Caribbean region, one of MPCES’ target locations, is often exposed to cyclones and hurricanes, which could heavily affect installed PV parks. Not only are those parks insured against such events, but structures are built increasingly more resilient, which should notably reduce down-times follow ing cyclones and hurricanes."

As you wrote, they are looking for Co-Investors. This leads to derisk also.

Something like this should be the answer from IR/Meichsner and has to be put in the annual report. Otherwise institutional investors will not come in flocks.

Another thought is about CEO / CFO. In the first videos with Martin Vogt and Stefan Meichsner, Martin was not the guy, I like to be an CEO. He had a reversed and not focussed mindset in my eyes. Stefan was the opposite and I am really glad that he has become the CEO.

Hope this was helpful for you too.

Martin